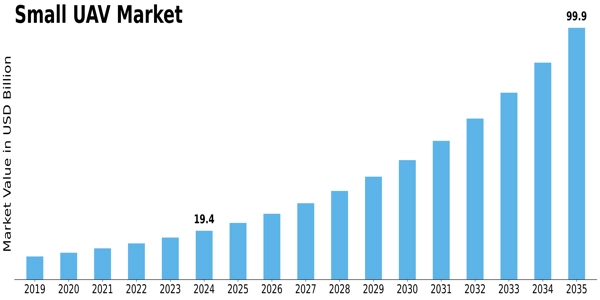

The emergence of versatile, high-performance small UAVs is redefining commercial operations across industries. According to data from Market Research Future, the small UAV market was estimated at USD 19.45 billion in 2024 and is on track to hit USD 100.11 billion by 2035 — marking a robust CAGR near 16%.

Market Outlook

Commercial entities are increasingly deploying small UAV marketfor tasks such as infrastructure inspection, land surveying, agriculture monitoring and logistics. These use-cases offer cost savings, improved safety and novel capabilities. Corporate and government investments in drone platforms and services are solidifying the market expansion trend. At the same time, defense and security remain strong contributors to growth. Still, challenges in regulation, safety and integration with conventional air systems are notable.

Industry Overview

Small UAVs provide a bridge between consumer drones and large unmanned aerial systems. Their agility, affordability and versatility make them especially attractive for commercial applications where human access is difficult or risky. The industry is also shifting from hardware-centric to service-centric models — drone-as-a-service, data analytics, fleet management. As connectivity improves and sensors become more capable, the ecosystem is poised for further maturation.

Key Players

Among leading firms in the sector are Lockheed Martin, BAE Systems, AeroVironment, DJI, Elbit Systems and SAAB. Their strategies include enabling modular payload configurations, securing long-term contracts, and expanding into emerging geographies. These firms are actively shaping standards and regulatory landscapes too.

Segmentation Growth

Analyzing the segmentation: by type, micro-UAVs dominated with roughly 70% of revenue in 2022, benefiting from their compact size and adaptability. By application, the civil/commercial segment captured around 65% of the 2022 market, underscoring how broadly business operations are embracing drones. Platform-wise, rotary-wing systems led (about 59% share in 2022), as their hover and placement flexibility fit many commercial use-cases. Regionally, North America dominates currently, but Asia-Pacific is expected to lead in growth rate — driven by infrastructure build-out and agricultural modernization in countries like China and India.

Conclusion

For organisations seeking to harness the benefits of small UAVs, the emphasis is shifting from “can we fly this” to “how do we monetise it”. Businesses that integrate drone fleets into workflows, offer value-added analytics and align with regulatory frameworks will gain competitive advantage. The commercial momentum is clear — and the growth horizon remains extensive.