As a seasoned global business setup consultant, I specialize in guiding entrepreneurs, SMEs, and corporations through seamless company registration, compliance, and tax structuring across international borders. With expertise in navigating diverse regulatory frameworks, I ensure your business meets local licensing, reporting, and operational requirements while optimizing tax efficiencies to reduce liabilities. From market entry to entity restructuring, I provide tailored strategies that align with your growth objectives, mitigate risks, and maintain global compliance. With a focus on company registration, I simplify complexity, saving you time and resources and unlocking sustainable opportunities worldwide. Let’s build a compliant, agile foundation for your global ambitions.

- Male

- 12/11/1998

- Followed by 0 people

Recent Updates

- The Best States to Register Your US Company in 2025 (Hint: It’s Not Just Delaware)

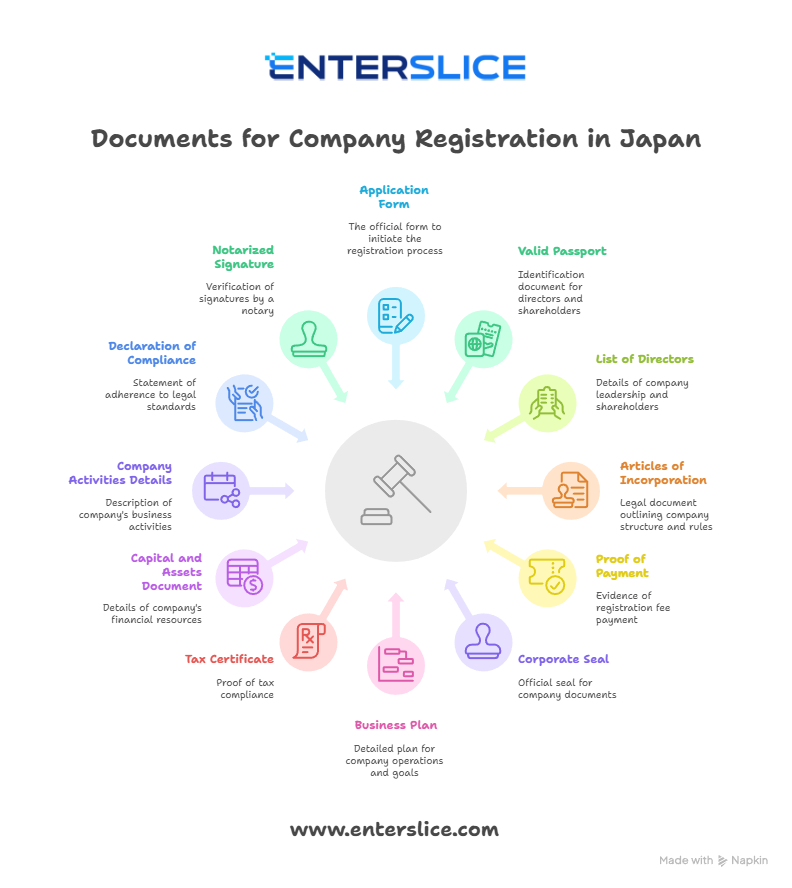

Discover the top states to register your U.S. company in 2025. While Delaware remains popular, surprising alternatives offer better tax benefits, privacy, and startup support. Learn which states truly stand out for new businesses this year.The Best States to Register Your US Company in 2025 (Hint: It’s Not Just Delaware) Discover the top states to register your U.S. company in 2025. While Delaware remains popular, surprising alternatives offer better tax benefits, privacy, and startup support. Learn which states truly stand out for new businesses this year.WWW.LINKEDIN.COMThe Best States to Register Your US Company in 2025 (Hint: It’s Not Just Delaware)Looking to register a company in USA? Discover the top states for USA company registration in 2025, and why Delaware isn't your only option.0 Comments 0 SharesPlease log in to like, share and comment! - Documents for Company Registration in Japan

To register a company in Japan, key documents include the Articles of Incorporation, notarized affidavit (for foreign nationals), proof of registered office address, personal identification of directors/shareholders, and capital deposit certificate. Additional documents may be required based on business type.

Know more: https://enterslice.com/jp/company-formation-japanDocuments for Company Registration in Japan To register a company in Japan, key documents include the Articles of Incorporation, notarized affidavit (for foreign nationals), proof of registered office address, personal identification of directors/shareholders, and capital deposit certificate. Additional documents may be required based on business type. Know more: https://enterslice.com/jp/company-formation-japan0 Comments 0 Shares - Free Zone vs. Mainland in 2025 | Dubai Business Registration Guide

Explore the key differences between Free Zone and Mainland business setups in Dubai for 2025. Learn which option suits your goals, ownership, and licensing needs in our expert business registration guide. Make informed decisions for success in Dubai.Free Zone vs. Mainland in 2025 | Dubai Business Registration Guide Explore the key differences between Free Zone and Mainland business setups in Dubai for 2025. Learn which option suits your goals, ownership, and licensing needs in our expert business registration guide. Make informed decisions for success in Dubai.WWW.LINKEDIN.COMFree Zone vs. Mainland in 2025 | Dubai Business Registration GuideConfused about company registration in Dubai? Learn the 2025 differences between Free Zone and Mainland for your Dubai company setup.0 Comments 0 Shares - Top 9 Things You Need to Know Before Registering a Company in Ireland

Discover the essential insights for setting up a business in Ireland. From legal requirements and tax obligations to choosing the right company structure, this guide covers the top 9 things you need to know before registering a company.Top 9 Things You Need to Know Before Registering a Company in Ireland Discover the essential insights for setting up a business in Ireland. From legal requirements and tax obligations to choosing the right company structure, this guide covers the top 9 things you need to know before registering a company.WWW.FRANCEWOW.COMTop 9 Things You Need to Know Before Registering a Company in IrelandThinking of starting a business in Ireland? Here's what every entrepreneur should know before company registration in Ireland.0 Comments 0 Shares - Director in a Singapore Company: Rules You Must Know

Understanding the rules for being a director in a Singapore company is crucial. From legal responsibilities to residency requirements, directors must comply with the Companies Act to avoid penalties and ensure proper governance of the business.Director in a Singapore Company: Rules You Must Know Understanding the rules for being a director in a Singapore company is crucial. From legal responsibilities to residency requirements, directors must comply with the Companies Act to avoid penalties and ensure proper governance of the business.BLAVIDA.COMDirector in a Singapore Company: Rules You Must Know - About Blavida.comDiscover essential rules for appointing a director in a Singapore company. Learn about residency requirements, responsibilities, and how to register an LLC in Singapore.0 Comments 0 Shares - Legal Requirements for Sole Proprietorship in Singapore

In Singapore, sole proprietorship must register with the Accounting and Corporate Regulatory Authority (ACRA), obtain necessary licenses, comply with tax regulations, and adhere to the Employment Act. Personal liability for business debts rests with the owner.Legal Requirements for Sole Proprietorship in Singapore In Singapore, sole proprietorship must register with the Accounting and Corporate Regulatory Authority (ACRA), obtain necessary licenses, comply with tax regulations, and adhere to the Employment Act. Personal liability for business debts rests with the owner.INSIDETECHIE.BLOGLegal Requirements for Sole Proprietorships in SingaporeLearn about the legal requirements for setting up a sole proprietorship in Singapore, including registration, taxes, licenses, and employment laws.0 Comments 0 Shares -

-

More Stories