The IT industry thrives on speed, precision, innovation, and efficiency. Yet behind the scenes, many IT firms still struggle with one operational area that often slows everything down: Accounts Payable (AP). Traditional AP workflows rely heavily on manual data entry, paper-based invoices, and repetitive validations — all of which are prone to errors, delays, and higher processing costs.

This is where RPA (Robotic Process Automation) and OCR (Optical Character Recognition) are stepping in to transform the game. Today, IT companies are rapidly modernizing their finance back-office processes by adopting smart automation. Many are also choosing to outsource accounts payable services for it industry to experienced specialists who already use advanced automation tools, reducing time, cost, and mistakes.

Let’s explore how these technologies are elevating AP accuracy and why this matters more than ever.

Why AP Processes Are Challenging in the IT Sector

IT companies deal with:

-

Multiple international vendors and suppliers

-

Complex pricing models and purchase orders

-

Software subscriptions and cloud usage billing

-

Cross-border tax and compliance requirements

With rapid scaling, invoice volumes can increase quickly — often more than internal teams can manage effectively. Manual AP processing leads to:

-

Delayed invoice approvals

-

Duplicate or missed payments

-

Difficulty in tracking payables

-

Vendor dissatisfaction

-

Increased audit risks

To stay competitive and financially agile, IT firms need AP processes that are faster, smarter, and more precise — not more complicated.

What Are RPA and OCR in Accounts Payable?

Before we dive into benefits, let’s simplify the concepts:

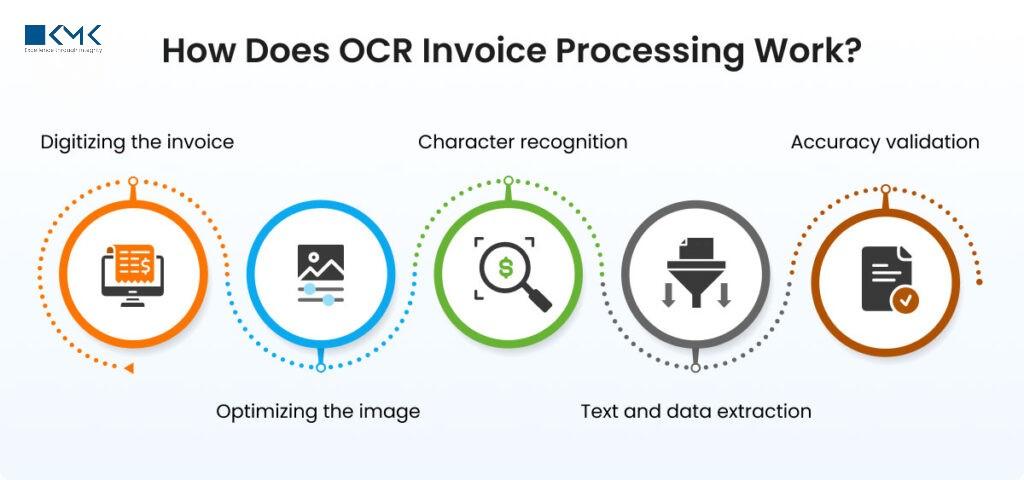

OCR (Optical Character Recognition)

OCR is a technology that reads text from invoices (PDFs, scanned documents, emails, and images) and converts it into structured data.

In other words, OCR automates data entry.

RPA (Robotic Process Automation)

RPA uses software bots to handle repetitive rule-based tasks.

These bots perform actions like:

-

Matching invoice data to purchase orders

-

Validating vendor information

-

Initiating approval workflows

-

Posting entries to accounting systems

Together, OCR and RPA automate the entire AP lifecycle — from invoice capture to payment posting.

How RPA and OCR Improve AP Accuracy

1. Elimination of Manual Data Entry Errors

Manual entry causes typos, wrong amounts, and mismatched vendor details.

OCR extracts data accurately and instantly, drastically reducing these mistakes.

2. Seamless Invoice Matching

RPA compares invoices with purchase orders and receipts in real-time.

If something doesn’t match — the bot flags it instead of letting the error slip through.

3. Faster Approvals

Bots automatically route invoices to the right team members based on approval rules.

This helps avoid delays caused by email back-and-forth.

4. Fraud Detection and Compliance

RPA can apply rule-based compliance checks, audit trails, and vendor verification steps to prevent unauthorized payments.

5. 24/7 Processing Capability

Bots don’t take breaks — meaning invoices can be processed overnight, improving cash flow predictability.

Why Automation Matters Specifically for IT Companies

IT firms operate in a highly competitive and margin-conscious environment. Every inefficiency has ripple effects:

| Challenge | Impact Without Automation | Improvement With RPA + OCR |

|---|---|---|

| High invoice volume | Team overload & backlogs | Auto-capture & instant processing |

| Vendor complexity | Payment errors | Smart matching & workflow routing |

| Multi-location operations | Fragmented systems | Centralized cloud AP system |

| Remote workforce | Approval delays | Digital & automated approval flows |

Automation ensures consistency, transparency, and financial control — crucial for scaling sustainably.

Combining Outsourcing and Automation for Best Results

While some IT companies try implementing RPA and OCR internally, many find it resource-intensive:

-

High software implementation cost

-

Need for skilled automation specialists

-

Continuous maintenance and updates

This is why outsourcing has become a practical solution.

When IT companies outsource AP operations to professionals who already use RPA + OCR systems, they gain:

-

Instant access to automation — without setup costs

-

Trained AP experts who understand IT vendor ecosystems

-

Reduced overhead and predictable monthly costs

-

Standardized workflows and accountability

-

Faster closing cycles and better audit readiness

This partnership model brings people + automation + process control together.

Real-World Example Scenario

Let’s say an IT company receives 500 invoices per month:

-

200 cloud services usage bills

-

150 vendor software license invoices

-

150 hardware procurement invoices

Without automation, the AP team may spend hundreds of hours monthly reconciling, approving, and posting them.

With OCR + RPA:

-

Invoice data is captured automatically

-

Details are validated against the vendor master and PO

-

Exceptions are flagged instantly

-

Approved invoices move to payment queue

Processing time can drop from 10+ minutes per invoice to under 1 minute — with improved accuracy.

Key Benefits IT Firms Gain from AP Automation

-

Reduced operational cost

-

Faster vendor payments and improved relationships

-

Lower risk of compliance issues

-

More accurate financial data for reporting and forecasting

-

Higher employee productivity and morale

Instead of chasing invoices, finance teams can spend time on strategic planning and insights.

Conclusion

RPA and OCR are reshaping how AP departments in the IT industry operate. They bring speed, accuracy, control, and transparency — all essential for a rapidly scaling business.

And when combined with a specialized outsourcing partner, IT companies can modernize their financial workflows without heavy investments or long implementation timelines.