Indonesia, Southeast Asia’s fourth-largest apparel market, is witnessing a surge in demand driven by rising disposable incomes, digital retail penetration, and growing fashion consciousness. With a large youth population and increasing urbanization, the Indonesia Apparel Market is rapidly evolving from traditional retail to a modern, tech-enabled fashion ecosystem.

This article dives deep into the Indonesia Apparel Market Trends, key players, competitive dynamics, and future outlook—while comparing its trajectory with regional peers like India and Vietnam.

📥 Indonesia Apparel Market to get exclusive insights on Indonesia’s apparel market segmentation, brand landscape, and demand forecast.

What’s Driving Indonesia Apparel Market Trends?

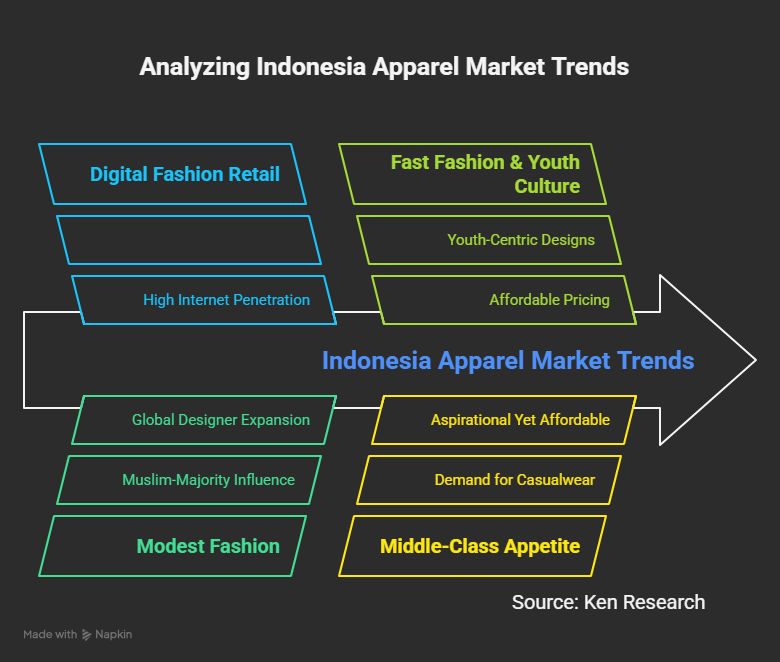

Indonesia’s apparel sector is being reshaped by several macro and microeconomic trends:

Rise of Digital Fashion Retail

With internet penetration exceeding 76%, platforms like Tokopedia, Shopee, and Zalora are dominating apparel e-commerce. Brands are launching online-first collections and using AI to forecast trends.

Shift Toward Modest Fashion

As the largest Muslim-majority country, Indonesia has seen a boom in modest wear, hijab fashion, and Islamic lifestyle apparel. Local designers are going global, especially in festive and bridal segments.

Fast Fashion & Youth Culture

Global and regional fast-fashion brands are expanding in cities like Jakarta and Surabaya. Youth-centric designs, K-pop inspired styles, and affordable pricing are gaining traction.

Growing Middle-Class Appetite

Indonesia’s emerging middle class seeks aspirational yet affordable clothing, leading to demand in casualwear, activewear, and workwear categories.

These forces collectively shape the Indonesia Apparel Market Trends, presenting both scale and scope for domestic and international players.

Challenges in Indonesia Apparel Industry

Despite growth, the market has its constraints. Here are the key Challenges in Indonesia Apparel Industry:

-

Fragmented Supply Chains: Many MSMEs struggle with inefficiencies in sourcing, inventory, and delivery.

-

Import Competition: Cheap textile and apparel imports from China pose a pricing challenge for local manufacturers.

-

Lack of Branding: Domestic brands often lag behind in branding, marketing, and design innovation.

-

Low Adoption of Tech in Manufacturing: Limited use of automation and AI in production hampers quality consistency.

-

Unorganized Retail Sector: Traditional retail still dominates in rural areas, slowing nationwide trend adoption.

Major Players in the Indonesia Apparel Market

Several companies are leading innovation and distribution in the market, across both domestic and international segments:

1. Matahari Department Store

One of the largest apparel retailers in Indonesia with nationwide presence, offering private-label and multi-brand collections.

2. Ramayana Lestari Sentosa

Targets the budget-conscious segment with a strong foothold in suburban and Tier 2 cities.

3. Zalora Indonesia

A major e-commerce player offering global fashion brands, fast shipping, and AI-based personalization.

4. Uniqlo Indonesia

With a rapid store expansion strategy and local partnerships, Uniqlo caters to minimal, high-quality fashion needs.

5. Eiger and Consina

Dominant in outdoor and activewear categories, catering to Indonesia’s adventure-loving youth.

These brands are setting the pace for product diversification, supply chain localization, and digital adoption in the market.

Indonesia Apparel Market Future Outlook

According to Ken Research, the Indonesia Apparel Market Future Outlook is optimistic. The market is expected to grow at a steady CAGR through 2028, driven by:

-

Expansion of organized retail into Tier 2 and Tier 3 cities

-

Rise of influencer-led fashion marketing

-

Government support through textile industry roadmaps

-

Improved logistics and warehousing infrastructure

This makes Indonesia an attractive destination not just for export manufacturing but also for retail investment and local brand growth.

Regional Benchmark: India and Vietnam’s Apparel Markets

Indonesia shares several structural similarities with India and Vietnam—large populations, textile production capacities, and growing fashion demand.

India Apparel Market

The India Apparel Market is one of the fastest-growing globally, driven by ethnic fashion, e-commerce, and private label expansion. The India Apparel Industry is investing heavily in smart textile hubs, AI in design, and export diversification under PLI schemes.

Vietnam Apparel Market

The Vietnam Apparel Market is a global export leader, especially to the U.S. and Europe. The Vietnam Apparel Industry is recognized for its advanced manufacturing, low-cost operations, and participation in high-value FTAs like EVFTA and CPTPP.

While Vietnam dominates exports and India leads in diversity and demand, Indonesia’s strength lies in its large domestic consumption base, modest fashion potential, and growing tech-driven retail sector.

Final Thoughts: Is Indonesia Ready for the Next Apparel Boom?

The Indonesia Apparel Market is at a strategic inflection point. With digitalization, demographic advantage, and cultural fashion richness, it’s set to become one of Asia’s fastest-growing fashion economies.

Investors, global retailers, and local brands must address manufacturing challenges and focus on branding, tech, and sustainability to unlock long-term value.

📊 Get the full analysis with growth forecasts, segmentation, and competitor strategies from the Indonesia Apparel Market Report.